From Lab to Market: Inspiring Success Stories in Tech Transfer

In the dynamic realm of venture capital, few narratives captivate an entrepreneur’s imagination more than the journey from lab bench to marketplace. Commercialized tech transfer, born out of collaborative efforts between university researchers and business leaders, holds the promise of transforming groundbreaking research into tangible solutions that enrich lives and drive economic growth. We love to share some inspiring success stories that illuminate the power and potential of tech transfer ventures.

Case Study 1: EARDG Photonics (Pronounced “Ear Dog”)

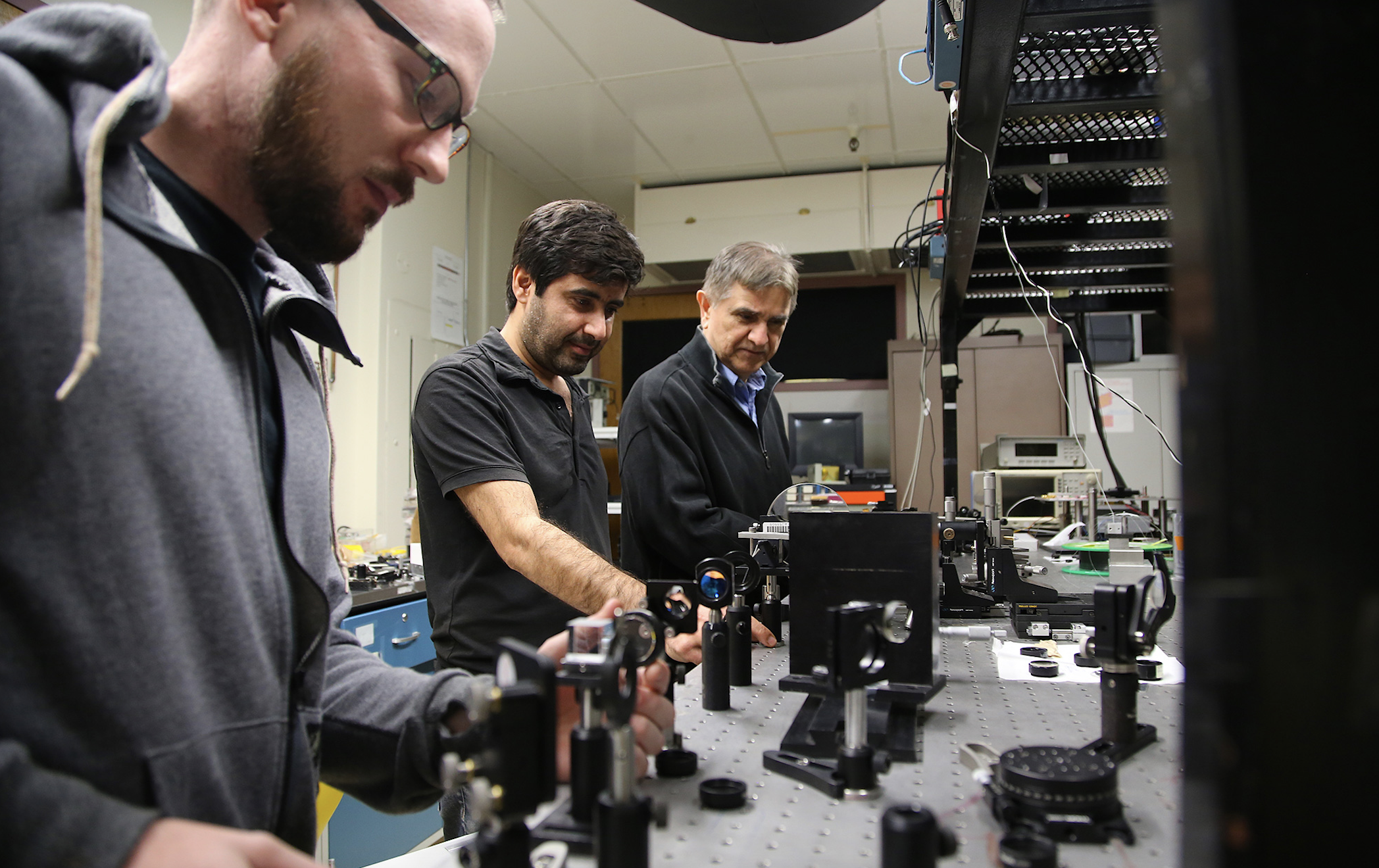

Let’s begin with the story of EARDG, a true innovation that emerged from the campus corridors of the University of Arizona. Stemming from pioneering research in the Optics College, this venture tackled the problem of visible light on eyeglasses when using augmented reality.

The prospect of augmented reality integrated into our daily lives is enticing but complicated. At home, you can escape with a huge headset and a stream of lights flickering in your display. However, out in public, you will look distracted, unapproachable, and illuminated. The team at EARDG believes in a future where you can bend light to create an augmented environment while still utilizing AR technology with discretion and privacy. With the end goal in mind, the EARDG team had a tremendous breakthrough using Volumetric Holographic Optical Elements and quickly issued a patent with the help of the University tech transfer office. With the patent secured and a working prototype available for demo, it was time to get this product out of the lab and into the world.

With a vision to bring their breakthrough technology to the masses, the team at EARDG approached UA Venture Capital regarding a seed investment. Even though there was a great product, there were still some massive hurdles to clear to make this reality. UAVC began helping the team with everything from negotiating licensing agreements to marketing plans, and every step was a balance of scientific rigor and business maneuvering.

We knew we had something special and needed to get the right people to take a closer look. The funding provided by UAVC allowed the EARDG team to get a booth at the annual CES show in a prime position. We set up in Vegas, and together, we worked the room to attract the most important innovators in AR to our booth. Once eyes were laid on this device, it was clear that a big technology player would implement this into a futuristic AR headset. The bidding war began.

The technology developed (and patented) on campus solved a problem that stumped hundreds of engineers in the industry. Our holographic breakthrough unlocked a key differentiator that could be miniaturized and integrated into a product already destined for the market. Talks around acquiring this business ramped up quickly, and since UAVC has been a part of more than 30 M&A transactions, we were able to take the lead and negotiate an exit that created faculty millionaires and 7x multiple on our original investment. All in under two years.

After the acquisition was completed, milestones were achieved, partnerships were forged, and the product moved rapidly into development. A version of this product will launch in 2024.

This case study exemplifies the collaborative spirit of capital and science that underpins every successful tech transfer venture.

Case Study 2: CarboShield, Inc.

Let’s focus on CarboShield, another shining example of transformative tech transfer. Stemming from a passion for Carbon Fiber, this venture embarked on a mission to save our crumbling infrastructure. CarboShield exists primarily to wrap and restore crumbling bridge pylons. If you have ever been near a water bridge or dock, you’ll often see rebar poking out of columns and a questionable amount of concrete missing from a pylon. The typical method of fixing one of these degrading pylons is to knock it down and replace it with a new (much more expensive one). It’s a highly involved construction project requiring divers and a barge with a concrete mixer. Unfortunately, it’s our tax dollars that are going towards this.

Embarking on their tech transfer journey, the team encountered challenges familiar to many. In a laboratory, you can only make small quantities at a limited size. In CarboShield’s instance, they made a shell capable of being tested on a bridge pylon in the Florida Keys. With this newly outfitted bridge, we tested the strength of pre/post-installation, and the results were outstanding. A University of Miami report showed that our Carbon shell had improved the bridge’s strength by 35x!!! This is the data point that gave us the confidence to invest and take this product to market.

Within a few months of launching, we were given the opportunity to save a bridge that was destined for demolition. Although they could not afford to replace the bridge, they were skeptically willing to allow us to repair it. The project was a major success and another proof point that this technology could be a critical savior to our crumbling infrastructure problem.

Through the lens of this case study, we uncover valuable lessons on innovation, collaboration, and the symbiotic relationship between academia and industry.

Reflecting on these remarkable journeys, certain themes emerge as guiding lights in tech transfer ventures. Whether it’s the importance of interdisciplinary collaboration, strategic partnerships, or the imperative of resilience in the face of adversity, these stories serve as blueprints for success in the ever-evolving innovation landscape.

Across the broad range of investment opportunities, tech transfer ventures stand as beacons of optimism and ingenuity. As we look to the future, we draw inspiration from these successes and continue to champion the relentless pursuit of research, the spirit of collaboration, and the unwavering belief in the potential of ideas to change the world. Without a little bit of capital and hustle, we can turn the breakthroughs of today into the realities of tomorrow.